Want to Close a Deal? Set a Deadline

Five ways to make it work.

By Sandi Leyva

The Complete Guide to Marketing for Tax & Accounting Firms

In the accounting profession, there are a ton of deadlines. Month-end, quarter-end and year-end. Payroll taxes, sales taxes and corporate taxes. And extension deadlines, filing deadlines and payment deadlines, to name just a few.

MORE: How Mindset Affects Your Marketing | Three Steps to Becoming a Millionaire | How to Use ChatGPT to Create Images | Create a Bad Website in Ten Easy Steps | Leverage Your Strengths to Beat Stress | Are You Crossing Off Your Business Bucket List? | Ten Ways to Make Your Business Irresistible | Five Ways to Target the Low-Hanging Fruit | Are Your Revenue Projections Realistic? | Six Strategies to Make More without Working More | The Art of Prompt Engineering for Accountants | Calculate Your Business Relationship Ratios

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

All of these deadlines may be a headache to business owners and accountants alike, but they are a marketer’s dream come true. How can you use deadlines to your advantage in marketing your services? And what if you are selling a service that is not in the accounting profession? Keep reading and we’ll answer these questions and provide you with five ways to woo your prospect with deadlines.

READ MORE →

Bissett Bullet: Do Your Homework

Today’s Bissett Bullet: “How often do you sense-check your proposals against previous projects? You have a wealth of information at your disposal. Before you present your solutions to a prospective client, do your research.”

By Martin Bissett

Does a precedent exist? How much did you charge clients in the past for the same work and more importantly, did you achieve an acceptable level of profitability as a result? Did you allow for everything you delivered or was there a degree of scope creep and in hindsight, did you price that work correctly?

Remember to take into account changes in your own circumstance as well as inflation, the benefit of the experience you have gained and any professional development you have subsequently undertaken.

Today’s To-Do:

Check a recent proposal against something similar in the past. How do the fees compare? Would you quote differently bearing in mind the above?

See more Bissett Bullets here

Steve Yoss, Quick Tech Talks: When A.I. Does the Heavy Lifting for Tax, Accounting and Finance Professionals

Subscribe to CPA Trendlines podcasts anywhere: Apple, Google, Spotify, iHeart, Deezer, Amazon Music and Audible, Player FM, Audacy, Gaana (India), and Boomplay (Africa).

Quick Tech Talk

With Steve Yoss

CPE Today

Besides OpenAI, Microsoft, Google, Facebook and the others you know,there are a number of really interesting and useful niche AI applications that are popping up as well, says Steve Yoss in this Quick Tech Talk.

These AI tools can leverage large language models, generative AI, machine learning, and more. They can do the heavy lifting for you. So you’re still in the position, in the driver’s seat of interpreting that information, making it useful and meaningful for your client. But you’ve got these robot workers that can do the heavy lifting for you to hopefully save you a bunch of time.

German Researchers Develop EV Motor with No Rare-Earth Magnets

Researchers may have found a way to speed up the shift to electric vehicles worldwide.

By Rick Richardson

Technology This Week

Currently, 95 percent of the rare earths come from China. Today, electric vehicle (EV) motors include rare-earth magnets, and if China decides not to share their supply, it will be catastrophic for the EV marketplace.

MORE: Educators Can Benefit from New Generative AI Course | AI Named the Highest-Paying In-Demand Tech Skill for 2024 | AI Generates Revolutionary New Battery Design | Breakthrough Implant Uses Excess Blood Sugar to Generate Electricity | Nuclear Battery Could Keep Your Future Phone Running for 50 Years | MIT Tests New Ingestible Vital Signs Sensor | Study: Solar Will Lead Global Energy by 2050 | New Tech Could Let EVs Go 3,000 Miles on a Single Charge | AI + MRI = Diseases That Doctors Might Miss | Your Boarding Pass Could Onboard Hackers | The First Police Officer on the Scene Might Be a Drone

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Of all the obstacles to transportation decarbonization, electric motors present one of the most compelling. Researchers are currently working on a development that could speed up the shift to electric vehicles worldwide: a tough, small, strong electric motor without rare-earth permanent magnets that can withstand high temperatures and has a high power density.

‘Radical Pricing’ Launches June 4 at AICPA Engage

The step-by-step process for building a more client-centric firm.

By CPA Trendlines

In Radical Pricing: How To Optimize Profits, Delight Customers and Build A Top Value Firm, which launches on June 4, Jody Padar guides accounting professionals through their pricing evaluation and remodeling.

Key points will be discussed at AICPA & CIMA Engage 24 conference at the Aria in Las Vegas on Tuesday, June 4, rom 7:00-7:50 a.m., sponsored bt ADP. Following the session ADP will host a book launch party where the first 50 attendees will receive a free autographed copy of the book. Registration is required at https://bit.ly/RadPricing.

The book and its accompanying workbook and tools are being published by CPA Trendlines and can be preordered at www.cpa.click/RadPricing.

Known as The Radical CPA®, Padar advocates for accountants to lead next-generation firms, and shares in her latest book why moving from a ticking clock will help firms retain talent, increase efficiency and create more loyal customers.

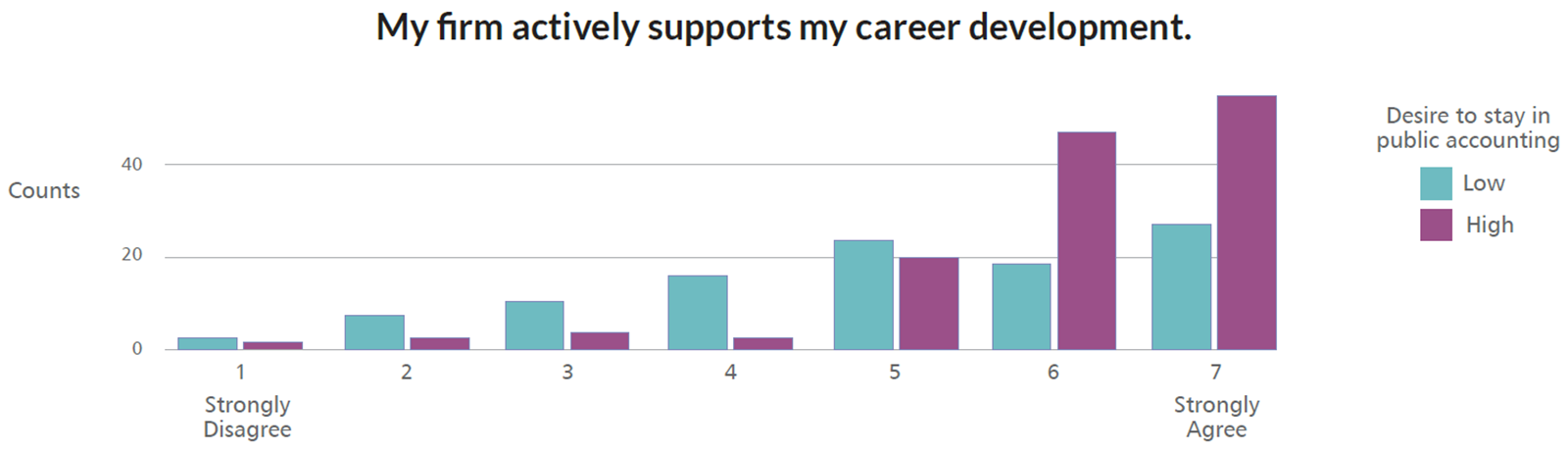

Seven Enticements to Keep Talent On Board

supports their career development.

Time is a concern, and so is performance.

By CPA Trendlines Research

The pipeline of incoming accounting professionals isn’t exactly gushing these days. To the contrary, it has slowed to an inadequate dribble.

The scarcity of qualified professionals makes talent retention more important than ever. It’s far easier and less costly to keep current people on board than to attract and onboard new people.

MORE: Employee Retention Is Easier Than Attraction | Let Interns Fix the Staffing Shortage? | Disruptors: Talent Crisis? What Talent Crisis? | Seven Steps to a Stronger Future | Firms Culling Clients as Staffing Woes Persist | Compensation’s Up, but Up Enough to Retain Staff?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

But what do they want? What keeps them happily at their current job?

Well, for one thing, money.

But these days, that’s not enough.

READ MORE →

How a Case of Beer Saved the U.S. Financial System

Great businesses are formed by trusting others … even if they need a 24-pack to get there.

By Frank Stitely

The Relentless CPA

You’ve probably heard of the 1929 stock market crash, Black Monday, the dotcom bubble and the Great Recession. All of these combined pale in comparison to what almost happened back in 1986. Save for a case of Miller Lite, our financial world, as we know it, would not exist.

MORE: Even with Value Pricing, Time Tracking Matters and Here’s Why | End Tax Season Meetings with Clients…Seriously | Get Clients to Understand Firm Processes … or Say Goodbye | Train Now Before It Costs You Down the Road | Keep Clients from “Balance Due” Shock | It’s OK to Say No to Clients (Even the Large Ones) | You Train Your Clients, Whether You Mean To or Not | Business Owners Face One of Three Exits

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

I landed this job not because of my fabulous accounting qualifications. I was a double major in economics/finance in college. I would have taken a job sniffing used toilet paper out of college with those academic credentials. I got the job solely from my relationship with Paul Karstetter, the second name in what eventually became Stitely & Karstetter, CPAs.