Employee Retention Is Easier Than Attraction

Five conclusions from a new report.

By CPA Trendlines Research

The accounting talent pipeline problem isn’t going away. It isn’t even improving.

But it isn’t hopeless.

MORE: Let Interns Fix the Staffing Shortage? | Disruptors: Talent Crisis? What Talent Crisis? | 3 Ways to Raise the Bar for Your Business | Accountants’ Advice: Be Careful, Quick, Creative … and Lean | Seven Steps to a Stronger Future | Accountants Bullish Locally, Bearish Nationally | Top Performers Lead in Leverage, Culling, Outsourcing | Auditing Standards ‘Yellow Book’ Updated | Firms Culling Clients as Staffing Woes Persist | Revenue Up at 59% of Accounting Firms … and More Good News | Compensation’s Up, but Up Enough to Retain Staff?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

A recent report from the Pennsylvania Institute of CPAs points out that, though the problem is big and the obstacles many, CPA firms can, with enough effort, hold on to the talent they’ve got.

And retaining talent is a lot less expensive than trying to attract it.

READ MORE →

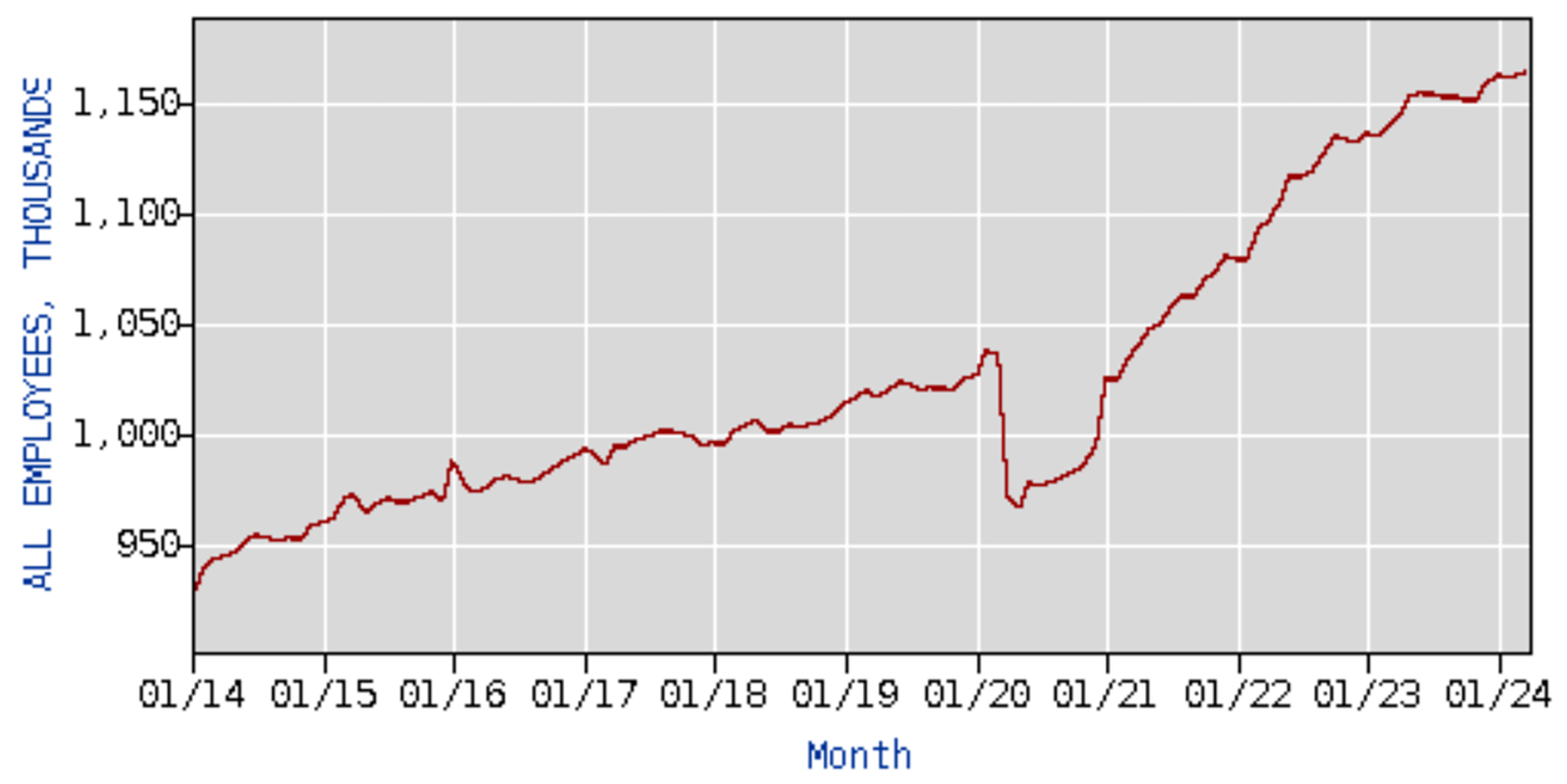

The tax and accounting profession is not a bad place for job seekers, it seems. A new analysis by CPA Trendlines shows a lot of up notes, including some in the double digits.

The tax and accounting profession is not a bad place for job seekers, it seems. A new analysis by CPA Trendlines shows a lot of up notes, including some in the double digits.